Click Image To Return To Hub Main Page

-

Companies Mentioned on this website and other spaces maintained by Perspective Reports are not affiliated with Perspective Reports Unless otherwise stated. All for educational and entertainment purposes unless otherwise stated.

2010s Electric Car Companies

Charts

Google Search Trends

Reddit Trends

Screenshot

Background

The electric vehicle (EV) landscape of the 2010s is a dramatic tale of immense hype and spectacular failure. During a period of intense investor excitement, a cohort of startups including Lucid Motors, Canoo Inc., Faraday Future, Nikola Corporation, and Lordstown Motors emerged as the supposed heirs to Tesla's throne. They captivated the market with flashy prototypes, celebrity endorsements, and ambitious promises, raising billions of dollars and achieving staggering market valuations. At one point, a single share of Faraday Future was valued at over $177,000. However, this initial frenzy masked a harsh reality: a shallow pit of disappointment was waiting for investors as these companies, one by one, saw their stock prices plummet by over 90%, with some collapsing into bankruptcy.

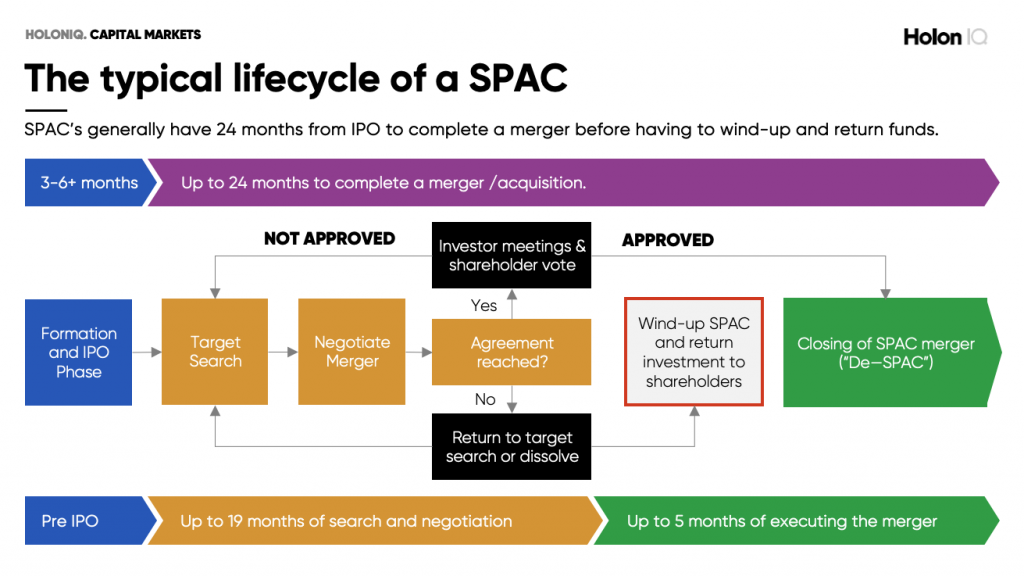

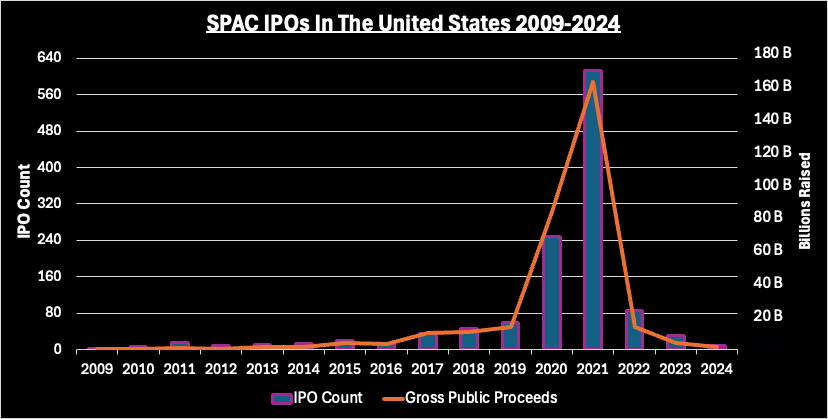

The core reason for this widespread failure wasn't the viability of electric vehicles themselves—their place as the future of transportation is largely undisputed—but rather a flawed and unsustainable business strategy. These companies grossly underestimated the monumental challenge of car manufacturing. Success in the auto industry requires an astronomical investment in infrastructure, a highly specialized workforce, robust supply chains, and a massive marketing effort to win over consumers. Instead of building this foundation, many startups opted for a shortcut to public funding through Special Purpose Acquisition Company (SPAC) mergers. This faster, less-scrutinized route to the stock market provided quick cash infusions but often papered over fundamental weaknesses in their operational plans, leaving them unprepared for the grueling reality of mass production.

The fallout from this hype-driven model is a trail of broken promises, legal troubles, and nearly empty factories. Nikola Corporation stands as the most glaring example, with its founder, Trevor Milton, being sentenced to four years in prison for securities fraud after it was revealed he "lied about all aspects of the business." Similarly, Canoo, after teasing partnerships with Hyundai and Apple, delivered only a dozen vehicles before filing for Chapter 7 bankruptcy. Lordstown Motors famously took out a loan from General Motors to buy a former GM plant, only to halt production of its "Endurance" truck after making just 450 units, eventually filing for bankruptcy itself. Even Faraday Future, despite its initial eye-watering valuation, had only managed to produce 16 cars by early 2025, a stark testament to the immense gap between its marketing and its manufacturing capabilities.

Ultimately, the downfall of these EV darlings offers a crucial lesson: in the capital-intensive world of automotive manufacturing, hype cannot replace substance. While Tesla's success proves it can be done, it's crucial to remember that its dominance was the result of a grueling 20-year journey, strategic long-term investments like the Supercharger network, and the steady leadership of a visionary CEO. The failed startups focused on generating buzz to attract investment, rather than investing to create a viable product and a loyal customer base. The road to an electric future is undeniable, but it is paved with the wreckage of companies that chose sizzle over steak. The next generation of successful American EV companies will be those that learn from this history, prioritizing engineering, production, and sustainable growth over flashy announcements and fleeting stock market glory.

Country Of Origin: United States Of America

Year Originated: Starting Around 2004

Corporate Affiliations/Ownership:

2010s American Electric Car Companies Facts

Car Production 2023-2024 For Examined Electric Vehicle Companies

2010s EV Companies Stock Information:

Lucid Motors Market Capitalization which is (total shares x share price) is 9.25B as of January 2025, their all time high stock price was $55.21 a share reached in Nov 2021. As of January 2025 their stock is valued at just over $3 a share a 94% drop from their all time high.

Canoo’s all time high stock price for a single share was $9,328 reached in Dec 2021. And in January 2025 at the time of bankruptcy a share of GOEV was worth $1.35, a 99.9% decrease.

By January 2025 Faraday had produced 16 cars all time. Their all time high stock price was $177,00 given the limited shares released and they have a market cap of 74M dollars far from their OG valuation of $3.4Billion, as of January 2025 a share of Faraday is $1.51

The All time high stock price for Lordstown Motors was $435 reached back in sept 2020 and as of Jan 2025 it is valued at $1.25 a share, a 99% decrease. Their Market cap is valued at $20Million

Workhorse’s all time high stock price was $812 per share. And as of Jan 2025 1 share of workhorse group inc. is worth $0.71 officially a penny stock

Nikola Corp (changed name in 2020) had an all time high stock price per share of $1,977 but now trades at $0.26 a share as of Feb 2025, yet another company reduced to a penny stock that we discussed in this video.

Global EV Market Share Growth 2020-2025

Still Going:

Lucid Motors: Lucid is actively producing and delivering its electric vehicles, including the Lucid Air sedan and the new Gravity SUV. The company continues to report production numbers and financial results, and its stock is traded on the NASDAQ. While facing significant financial challenges and losses per vehicle, it remains a fully operational automaker.

Faraday Future: Despite extreme financial difficulties, very low production numbers (selling only a handful of its high-priced FF 91), and ongoing operating losses, Faraday Future is still operational. The company continues to announce plans for future, more mass-market models and is actively traded on the NASDAQ.

Workhorse Group: Workhorse is still in business, focusing on commercial electric vehicles like delivery vans. The company is actively expanding its dealer network, announcing new contracts, and its stock is traded on the NASDAQ.

Restructured / Reorganized:

Lordstown Motors (now Nu Ride Inc.): Lordstown Motors filed for Chapter 11 bankruptcy in June 2023. It has since emerged from bankruptcy restructured as a new entity called Nu Ride Inc., with its headquarters moved to New York City. While it no longer produces the Endurance pickup truck, Nu Ride exists as a public company with assets it intends to use for future business combinations or acquisitions.

No Longer Operating:

Canoo Inc.: Canoo filed for Chapter 7 bankruptcy and ceased all operations in January 2025. The company is currently undergoing liquidation, where a court-appointed trustee is overseeing the sale of its assets.

Nikola Corporation: After a tumultuous period that included the criminal conviction of its founder, Nikola Corporation filed for Chapter 11 bankruptcy in February 2025. The company is in the process of liquidation, selling off its assets, including its Arizona factory which was sold to Lucid Motors. It is no longer operating as a going concern.

Estimated One Time TOTAL Worth OF

6 Analyzed Eelctric Vehicle Companies

Estimated Current TOTAL Worth OF

6 Analyzed Eelctric Vehicle Companies

Extra Visuals:

Suggested Strategies As of June 2025

Many electric vehicle (EV) startups have been treated as "hype stocks," attracting retail and major investors who, often unknowingly, are funding the very foundation and infrastructure of these nascent companies, rather than supporting established production lines. These companies frequently boast ambitious shipping claims, yet their poor production numbers reflect a lack of existing customer bases, leading them to prioritize building a fanbase over genuine innovation in EV technology. This creates a precarious situation for investors, as their capital is essentially building a company from the ground up, with little immediate return or recourse.

1.

2.

Tesla, once the undisputed leader, is seeing a reverse effect as Elon Musk's personal ideals and ventures increasingly influence the company, potentially at the expense of its business investments and core mission. This opens the door for competitors like Rivian, which possesses high potential but needs to significantly improve its brand building to genuinely compete. The American market presents unique challenges for EVs due to the deep-seated "petro-dollar" legacy; despite a recognized need for change, the substantial cost of transitioning is not adequately supported by either consumers or the current administration, forcing EV startups to shoulder immense capital burdens to shift societal behavior.

3.

Purely vehicle-focused EV companies struggle to succeed against giants like Tesla due to insufficient upfront capital and a lack of established brand recognition, issues many have attempted to address with limited success. Tesla, in contrast, benefited from the substantial "PayPal mafia" money that initially funded Elon Musk's ventures, allowing him to pursue more ambitious (and sometimes disruptive) "side quests." A new era of EV companies is essential—one that moves beyond the "hype model" and instead embraces the practical, "meat and potatoes" conventionality that resonates with the American market. Future successful American EV companies will be those that demonstrate true productivity, strength, and deep roots in their product, earning consumer trust through tangible value rather than just promises.

American Electric Vehicles will get a second wind, but it will take fresh faces and ideas that work with the reality of the market and people that will see sustained success. - Perspective X

Perspective Reports Content

Featuring 2010s Electric Vehicle Companies

Sources And Links To More Information: