The Tax Decoder

Taxes Aren't a Monster, They're a Game.

"Taxes" feel like a punishment, but they're just the operating cost of a country. You're not being "punished" for earning money; you're paying your share for the "servers" that run society (roads, schools, police, parks, etc.).

This guide is your 'cheat sheet' to understanding the rules of the game. The goal is simple: **Pay exactly what you owe, and not one penny more.**

- The "Refund Myth": A big refund isn't a prize. It's an interest-free loan you gave the government.

- The "Side-Hustle Shock": Learn why your DoorDash income is taxed differently (and *way* more) than your W-2 job.

- The Goal: Your goal isn't to *evade* taxes, it's to *legally optimize* them.

1. Your First Job (W-4 vs. W-2)

You got a job! Your first two encounters with the "Tax Game" are the W-4 and the W-2. They are *not* the same.

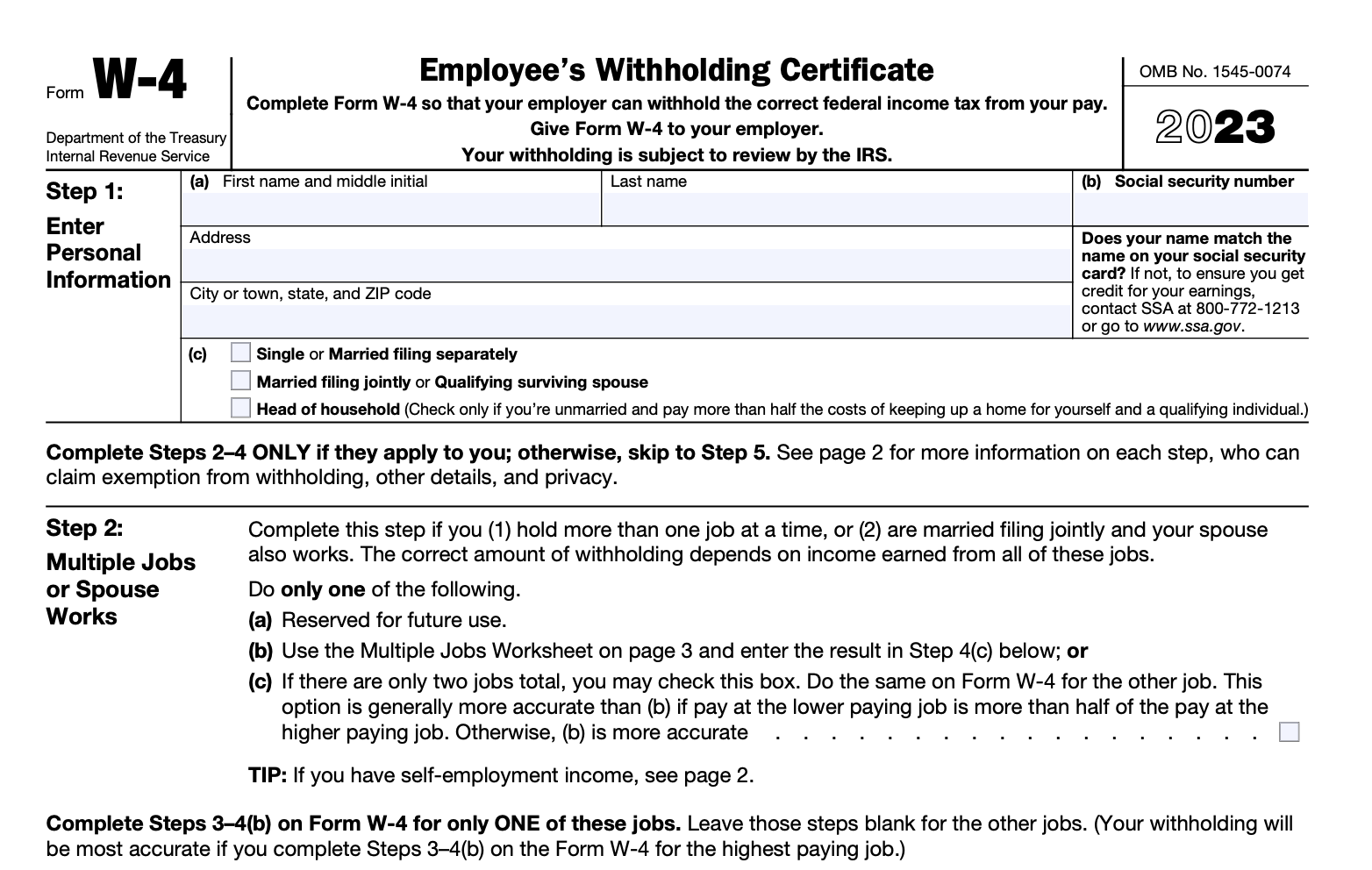

The W-4: Your "Pre-Payment" Plan

You fill this out *before* you get paid. It's you *telling* your employer how much tax to "withhold" (pre-pay) from every paycheck.

- More Allowances/Dependents: You tell them to take *less* tax out. (Your paycheck is bigger).

- Fewer Allowances/Dependents: You tell them to take *more* tax out. (Your paycheck is smaller).

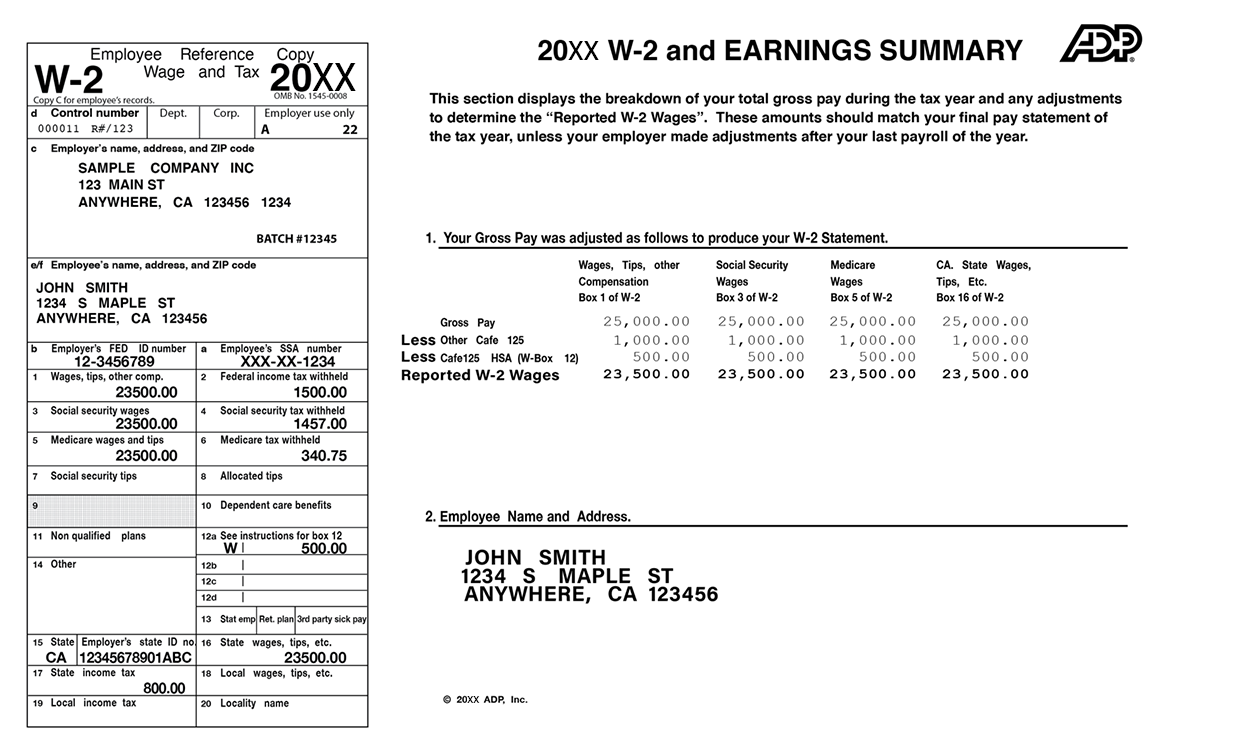

The W-2: Your End-of-Year "Receipt"

You get this *after* the year ends. It's your employer's "receipt" to you and the IRS. It says:

// This is what we paid you:

Total_Wages = $50,000

// This is what we pre-paid to the IRS for you:

Federal_Withholding = $4,500

State_Withholding = $2,000

The Refund Myth

A refund is NOT free money. It is the government giving you *your own money back* because you overpaid.

The "Filing" process is just settling the bill:

- The IRS says your $50k income means you owe $4,000.

- Your W-2 receipt says you pre-paid $4,500.

- Result: $4,500 (Paid) - $4,000 (Owed) = $500 Refund.

- The Goal: Adjust your W-4 so your refund is as close to $0 as possible.

Audit-Bot 9000

Q1: You want a *bigger* paycheck every two weeks. What do you do on your W-4? (Add more dependents or fewer dependents?)

> AUDIT-BOT: Ready. Awaiting W-4 input...

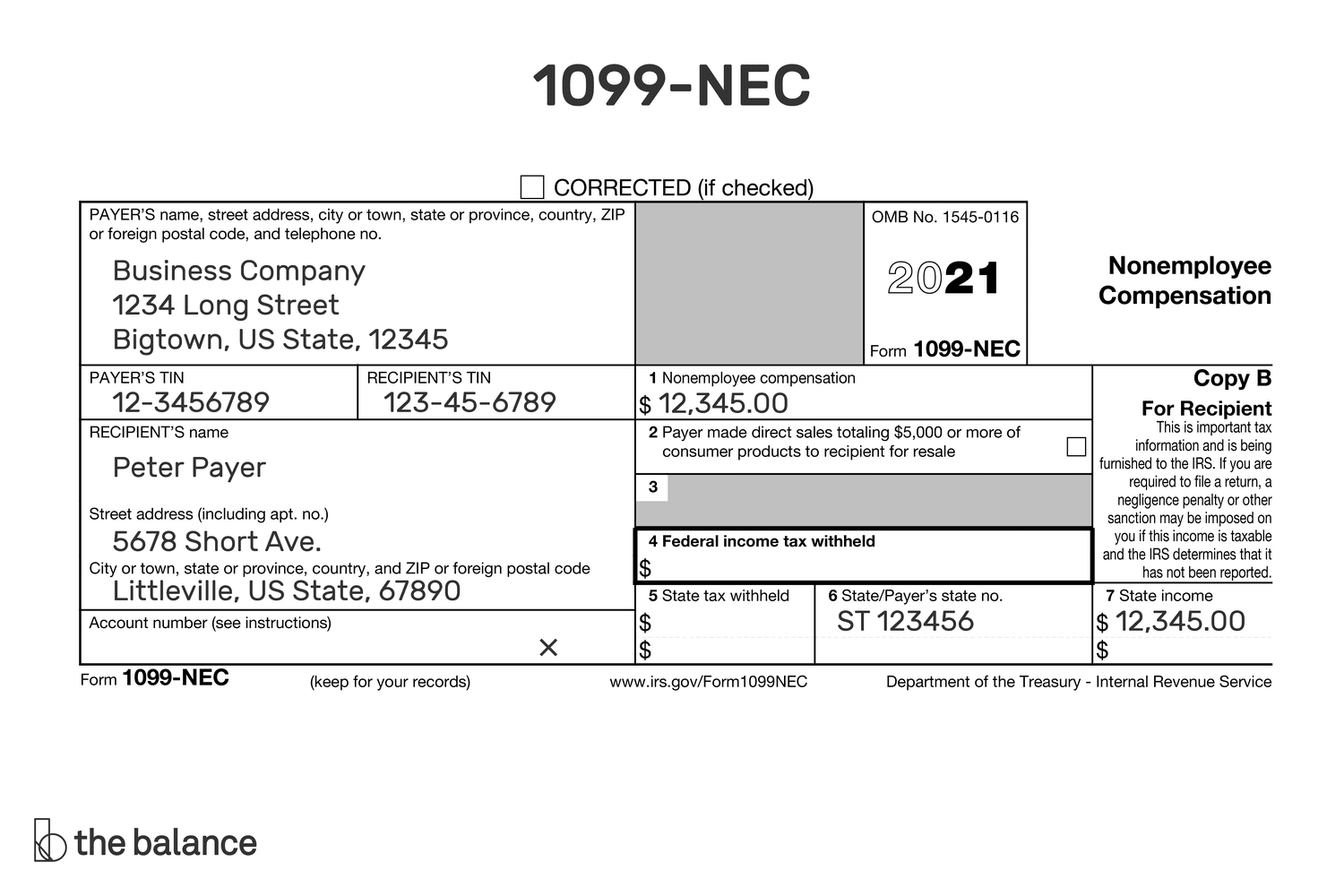

2. The Side-Hustle (W-2 vs. 1099)

This is the #1 tax shock for your generation. Your Etsy shop, DoorDash route, or freelance gig is NOT like your Starbucks job. You are now a **business**.

| Feature | W-2 (Employee) |

|---|

Audit-Bot 9000

Q1: You earned $5,000 driving for Uber (1099). Your *only* expense was $1,000 in gas/miles. What is your "Net Income" (the amount you actually pay tax on)?

> AUDIT-BOT: Ready. Awaiting 1099 input...

3. Filing Day (Deductions vs. Credits)

This is where you "play the game" to legally lower your bill. You use **Deductions** (discounts) and **Credits** (gift cards).

Deductions = A "Discount"

A deduction lowers your *taxable income*. It's a discount before the tax is calculated.

Example: You earn $50,000. You have a $1,000 deduction (e.g., Student Loan Interest). Now, the IRS only *sees* $49,000 of your income. If you're in the 22% bracket, this saves you **$220** ($1,000 x 22%).

Credits = A "Gift Card"

A credit is a dollar-for-dollar reduction of your *actual tax bill*. It's 100x better than a deduction.

Example: You owe the IRS $1,000. You have a $1,000 tax credit (e.g., American Opportunity Credit for college). Your bill is now **$0**.

The "Standard Deduction" (The Free Coupon)

The IRS gives *everyone* a giant "free coupon" called the Standard Deduction (e.g., ~$14,600 for a Single filer in 2024).

- 90% of people just take this free coupon. It's easy.

- You only "Itemize" if your personal deductions (like massive mortgage interest, state taxes, or charity donations) add up to *more* than the free coupon.

Audit-Bot 9000

Q1: You are in the 22% tax bracket. Which saves you more money: a $1,000 *deduction* or a $500 *credit*?

> AUDIT-BOT: Ready. Awaiting Form 1040...

4. How Tax Brackets *Actually* Work

This is the most misunderstood part of taxes. A raise can **NEVER** make you take home less money. You don't "fall into" a new bracket.

Taxes are "marginal." Think of them as buckets you fill up, each with a different tax rate.

Example (Single Filer): You earn $50,000.

- Your first ~$11k is taxed at 10%.

- Your next chunk (up to ~$47k) is taxed at 12%.

- Only the tiny bit over $47k is taxed at 22%.

5. Common Bugs (Avoid These!)

The IRS is an automated system. If you feed it bad data, it will find it. Here are the most common "runtime errors" to avoid.

Error: `DATA_MISMATCH_1099`

The Bug: You got a 1099 from Uber for $8,000 but "forgot" to put it on your tax return.

The Fix: Don't do this. Ever.

The IRS gets a copy of *every* W-2 and 1099 sent to you. Their computers *automatically* check your return against their records. If it doesn't match, you will get a bill (a CP2000 notice) for the taxes, penalties, and interest. It's not a question of *if* they'll find it, but *when*.

Error: `DEADLINE_EXCEEDED`

The Bug: It's April 15th, you owe $1,000, and you don't have the money. So you just... don't file.

The Fix: ALWAYS File, Even if You Can't Pay.

The "Failure to File" penalty is ~5% *per month* on the amount owed (up to 25%).

The "Failure to Pay" penalty is ~0.5% *per month*.

The penalty for *not filing* is 10x worse! You can file an extension for free. You can set up a payment plan. Just don't ghost the IRS.

Error: `UNDECLARED_CAPITAL_GAINS`

The Bug: "I bought Bitcoin and sold it, but it's just digital money, so it's not taxable, right?"

The Fix: It is 100% taxable.

Crypto is treated as "property." When you sell, trade, or *use* it (like buying a pizza with BTC), you have a "taxable event." If you made a profit (sold it for more than you paid), you owe **Capital Gains Tax**. All major exchanges now report to the IRS.