Click Image To Return To Hub Main Page

-

Companies Mentioned on this website and other spaces maintained by Perspective Reports are not affiliated with Perspective Reports Unless otherwise stated. All for educational and entertainment purposes unless otherwise stated.

Star Wars

Charts

Google Search Trends

YouTube Search Trends

Reddit Trends

Screenshots (3 Months April 2025-July 2025)

Pinterest Trends

Screenshots (2 Years July 2023-July 2025)

Background

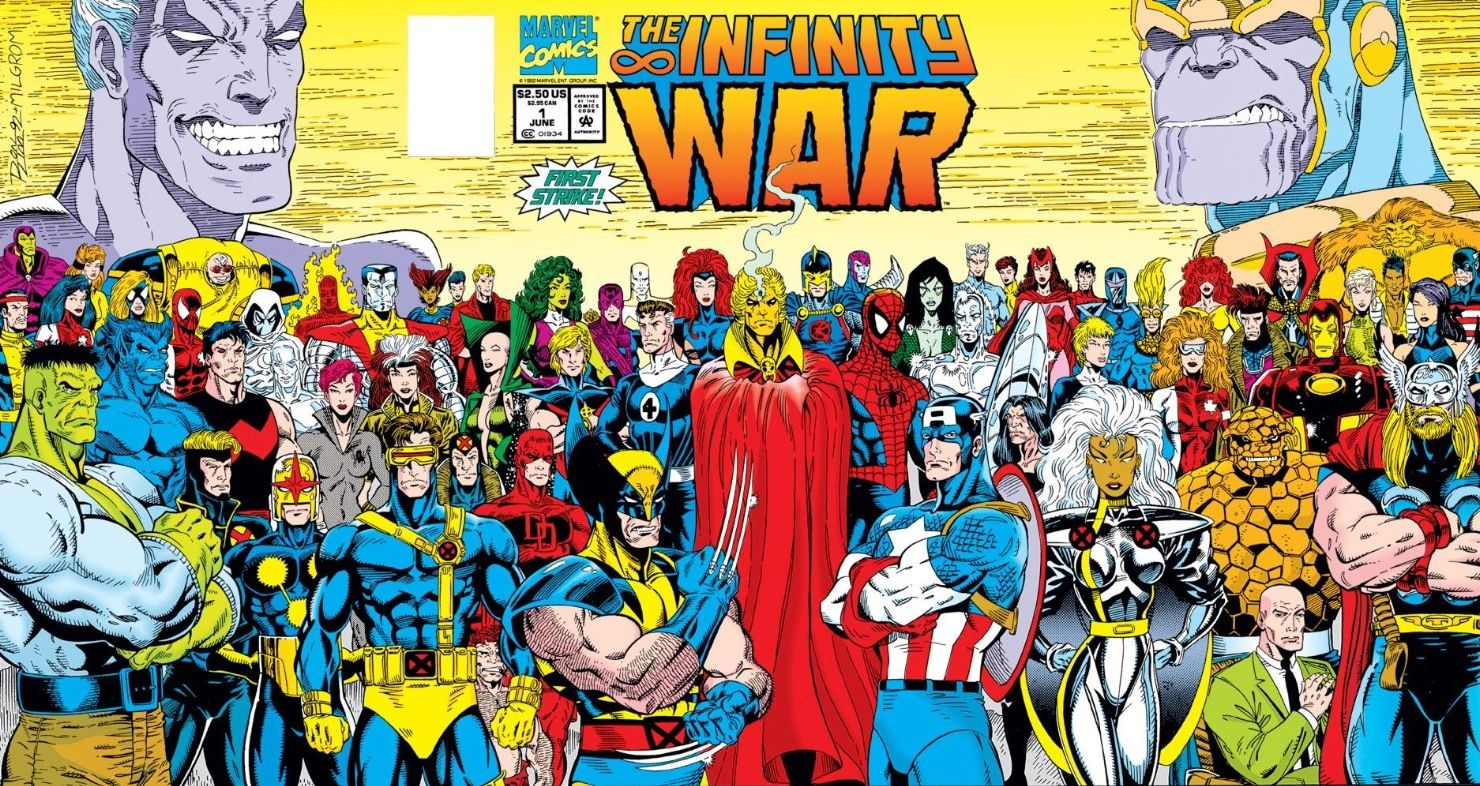

Marvel Comics stands as a titan in modern mythology, having redefined the superhero genre for over 80 years. Their initial strategy, dubbed the "Relatability Revolution," involved creating flawed, human characters like Spider-Man (the everyman), the Hulk (inner struggle), and the Fantastic Four (a bickering family). This established them as approachable and led to unprecedented early growth in readership, with characters tackling real-world issues and resonating with a new generation of fans by the 1960s. This strategic move cemented their characters as cultural icons by reflecting societal anxieties and aspirations, making Marvel the dynamic, cutting-edge home for heroes.

However, Marvel's journey has also been marked by significant missteps. In the 1990s, "Over-Saturation Syndrome" became a major hurdle as their aggressive expansion and numerous tie-ins felt diluted compared to the more focused narratives of their competitors. While their "Event-Driven Storytelling" like Civil War in 2006 proved successful in generating buzz and sales by creating seismic shifts in their universe, their later attempts to replicate their comic book success with a "Fragmented Film Rights" approach fell flat initially. This fractured ownership led to character absences and a disjointed cinematic landscape, highlighting a crucial "Licensing Labyrinth" in their mainstream marketing.

Despite these challenges, Marvel has found immense success with "Interconnected Cinematic Universes," exemplified by the Marvel Cinematic Universe (MCU). These projects elevated the brand by positioning Marvel as the home of epic, sprawling superhero sagas, proving that a cohesive, long-term vision can resonate deeply with audiences. The key takeaway from Marvel's marketing history is that while their characters' relatability is a powerful asset, a clear, unified control over their intellectual property is crucial for them to maintain and expand their position as a dominant force in entertainment.

Country Of Origin: United States Of America

Year Originated: 1939

Corporate Affiliations/Ownership:

Marvel Cinematic Universe Movies Gross Revenue (2008-2024)

Marvel Comics Facts

Comic Book Sales North America 2011-2022

Marvel Comics and Entertainment as a Business Entity:

Marvel Comics Revenue & Market Share

While it's difficult to pinpoint exact revenue figures for Marvel Comics as a standalone entity due to its integration within The Walt Disney Company (TWDC), estimates for its annual revenue vary. Some reports suggest Marvel Comics' estimated annual revenue is around $1.1 billion, while others place it in the $200M-$300M range for just the publishing arm. In terms of market share within specialist comic book store sales, Marvel Comics held approximately 40.0% in Q1 2025, placing it first among all comic publishers.

Parent Company and Financial Context

Marvel Comics is a subsidiary of The Walt Disney Company (TWDC), a leading global entertainment and media conglomerate. TWDC's overall financial performance largely dictates the resources and investment available to Marvel. For the full year 2024, TWDC reported total revenues of $88.9 billion, a 3% increase year-over-year. The company reported a net income of $12.6 billion for FY 2024, driven by strong performance in its Parks, Experiences and Products segment and growth in its streaming services.

Valuation and IP Significance

The valuation of Marvel's intellectual property (IP) is substantial, often valued in the tens of billions of dollars, far exceeding that of its competitors. While not a publicly traded stock on its own, the "value" of Marvel is deeply intertwined with TWDC's overall market capitalization and its strategic importance within the company's portfolio. The continued success of major Marvel Cinematic Universe (MCU) film and television projects, such as upcoming Avengers films and Disney+ series, is seen as crucial for reaffirming the value of the Marvel brand and significantly impacting TWDC's stock performance.

Key Initiatives in the 2020s

Marvel has focused on several key initiatives, including:

"Fresh Start" and subsequent publishing initiatives: These initiatives involve launching new ongoing series, refreshing creative teams, and introducing new characters and storylines to attract new readers while retaining existing fans.

Continued expansion of the Marvel Cinematic Universe (MCU): Marvel Studios continues to expand its interconnected film and television universe, introducing new phases, characters, and storylines that drive significant box office and streaming viewership.

Emphasis on diversity and representation: Marvel has continued to promote diverse characters and storylines across its comics and cinematic ventures, including successful introductions of new heroes and narratives that reflect a broader range of experiences.

Digital presence and accessibility: Marvel has significantly expanded its digital comic offerings through platforms like Marvel Unlimited, making its vast library more accessible and catering to the growing digital consumption market.

Profitability Trends (Broader Comic Market)

The overall comic book market is experiencing growth. The global comic book market size was estimated at $18.14 billion in 2025 and is projected to reach $23.61 billion by 2030, growing at a CAGR of 5.41%. Non-digital formats still hold a significant share, but the digital segment is projected to expand at a 9.4% CAGR through 2030. The emphasis on deluxe editions, collected editions, and collector items helps maintain profitability in the print market despite rising costs.

Estimated TOTAL Worth OF

DC Comics and Entertainment

Examples Of Merchandise and Licensing of Marvel Characters

Video game artwork showing Marvel characters with Marvel's Captain America in the foreground, Marvel villains, and characters from Fortnite against a castle background.

Red and black Spider-Man themed sneakers with white soles, white laces, and a red Velcro strap with an illustration of Spider-Man.

A running shoe featuring a red, black, and blue color scheme with gold highlights, a white textured midsole, and a pattern resembling a starry night sky.

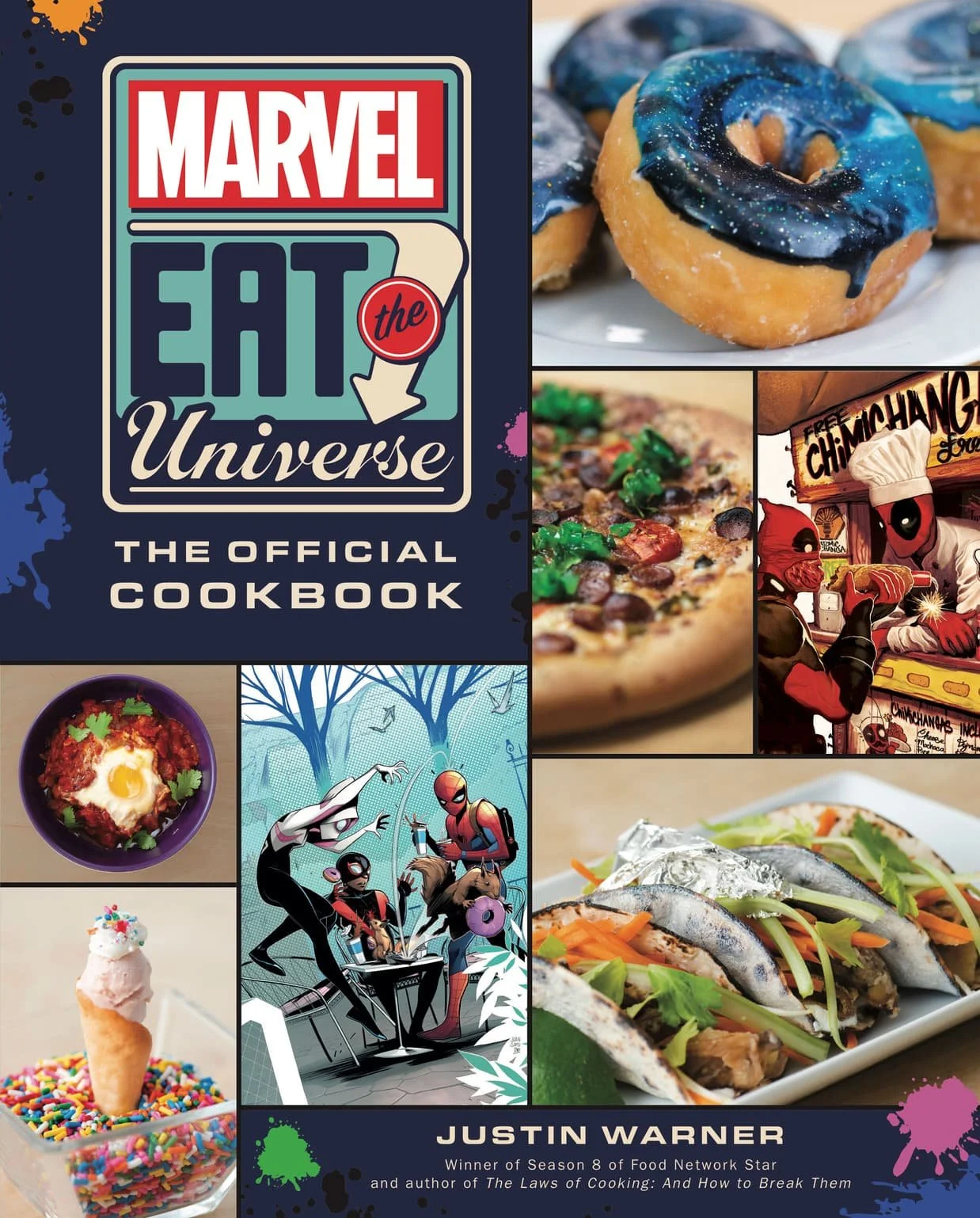

Cover of Marvel Eat the Universe: The Official Cookbook featuring images of various dishes and Marvel characters.

Comic-style Deadpool with a thumbs-up, a steaming pan of pasta, and a plate of spring rolls, on a black background with text about a Deadpool-themed cookbook.

A bag of Pepperidge Farm Goldfish baked snack crackers in special edition Marvel Avengers packaging, featuring Thor and Black Panther characters.

Cover art for LEGO Marvel Avengers: Mission Demolition featuring LEGO versions of Marvel superheroes like Iron Man, Captain America, Thor, Hulk, Black Panther, and others, with LEGO bricks and cityscape background, and yellow lightning bolts.

Three pairs of Marvel-themed boys' boxer briefs with superhero and logo designs, arranged vertically.

Blue and red Spider-Man themed children's bicycle with training wheels, featuring Spider-Man graphics on the frame and wheels, and a Spider-Man helmet attached to the front.

Soccer ball with Marvel Captain America shield design, featuring red, white, blue, and star symbols, with branding and MLS logos.

Four bottles of Suave Kids Spider-Man 2-in-1 shampoo and body wash with blue bottles and pump dispensers

A bottle of Marvel Avengers children's shampoo with an Iron Man illustration on the front.

A skateboard deck featuring a Spider-Man design with holographic accents.

Six vintage Marvel comic-themed pocket knives with superhero images and titles, arranged on a dark surface.

Pack of GoodNites bedtime underwear featuring Spider-Man on the packaging.

Person holding a large towel featuring comic book style images of Marvel superheroes Captain America, Spider-Man, Iron Man, Hulk, Thor, and Black Widow at the beach.

Cover art for Marvel Ultimate Alliance video game for Xbox, showing Spider-Man in the center, with Iron Man, Wolverine, Thor, and other Marvel characters around him.

Coloring book cover titled "Heroes and Villains" featuring comic book characters like Spider-Man, Captain America, Ant-Man, the Wasp, and others in a black-and-white comic style drawing with some characters colored.

A Citizen Eco-Drive watch featuring a DC Comics Justice League design with superhero characters on the dial, including Batman, Superman, Wonder Woman, The Flash, and others.

Spider-Man themed bop bag for children, featuring Spider-Man and Venom characters, packaged in a blue box with a boy playing with the bag.

Set of seven Marvel superhero action figures including Captain America, Iron Man, Black Panther, Spider-Man, Deadpool, Hulk, and Falcon in packaging with Marvel branding and colorful comic-style graphics.

Advertisement for Deadpool-themed aviation American gin with Deadpool logo and bottles of gin.

Four bottles of Marvel Super LXR hero hydration drinks in peach mango, citrus lemon lime, acai blueberry, and dragon fruit watermelon flavors.

Collage of Spider-Man themed items: a pillow with Captain America's shield design, Spider-Man themed cups, a Spider-Man lunchbox, and a laser light projector creating colorful light reflections on a wall.

A white mug with black handle and interior, featuring two stylized masks—one red labeled 'Best' and one yellow labeled 'Friends'—connected in a split heart shape.

White baseball cap with 'X-MEN' embroidered in beige and blue lettering.

Collection of merchandise including T-shirts with science fiction themes, a pair of red and black socks with a woman's face, and Funko Pop figures of female characters, set against a dark background.

Left side shows Marvel Black Panther-themed jewelry box with a pair of earrings, and Marvel Wakanda Forever branding. Right side features a silver necklace with a hexagonal, heart-shaped pendant hanging on a red box against a brick wall background.

Captain America and The Winter Soldier merchandise, including a plush toy, socks, a black T-shirt, and a mask.

Collection of Guardians of the Galaxy-themed toys including a Groot mask, a Rocket raccoon figure with weapons, a gun toy, a tree-like character figure, and a Star-Lord figure with guns.

A collection of superhero-themed clothing and accessories featuring a blue and red jacket, a miniature superhero doll, a blue dress with red accents, and a white T-shirt with a superhero graphic and speech bubble.

A collection of Marvel Spider-Man themed items including a hoodie, pajamas, a captain America's shield, a Spider-Man bubble spray, a Spider-Man themed water gun, a Spider-Man hand glove, a Spider-Man backpack, and a Spider-Man puzzle box, all placed on a blue surface.

Extra Visuals:

Suggested Strategies As of June 2025

Fatigue Avoidance

1.

2.

Need a new Avengers like Storyline to compete with future Infinite Earths storyline from DC Comics that will do well.

3.

Hype and Cycles matter, but how do you replicate Marvel success outside of the films directly is key, resort worlds, hotels. Maybe Marvel gets its own theme park (San Diego area). Many options to deal with the inevitable down cycle after years of strong success.

Marvel is now the king of comics, but that means each new opportunity for the medium is something competitors can take advantage of, similar to the DC Compact comics, innovating with what you have will be most beneficial. Regardless, Marvel and Disney must be proactive stewards of the IP if they want the relevance of Marvel to not have been just another trend from the 2010s and 2020s. - Perspective X

Perspective Reports Content

Featuring Marvel Comics and Entertainment

Sources And Links To More Information: